capital gains tax services

The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25 rate. That applies to both long- and short-term capital gains.

Tax Prep Tax Preparation Income Tax Preparation

Hawaiis capital gains tax rate is 725.

. Long-term capital gains are gains on assets you hold for more than one year. Visit our Contact page for a map. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation.

Pre- 1 October 2001 CGT capital gains and losses are not taken into account. They are subject to ordinary income tax rates meaning theyre. For UK residents the gain would also be taxable in.

Capital gains tax rates on most assets held for a year or less correspond to. You are well served to work through your trusted tax. Capital Gains Tax CGT Capital Gains Tax is a tax on the profit you make from disposing of your asset.

A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Capital Tax and Financial Services Inc. TaxAct Premier Best Value-for-Money Tax Filing Service.

Thumbtack finds you high quality Accountants lets you book instantly. Capital gains tax is the tax Americans must pay on any profits generated from the sale of assets including stocks real estate and businesses. Its the gain you make thats taxed not the.

Prices to suit all budgets. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for. A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares.

Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. First calculating capital gains tax can be very complicated. Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a.

ICE Data Servicess Capital Gains Tax CGT services can. ICE Data Services has over 40 years experience as a leading provider of Capital Gains Tax services. You can use the real time Capital Gains Tax service immediately if you know what you owe.

Capital Tax and Financial Services Inc. Homeowners who meet certain conditions can. Offering a range of invaluable reference tools for accountants and tax professionals.

Theyre taxed at lower rates than short. That means you pay the same tax rates you pay on federal income tax. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

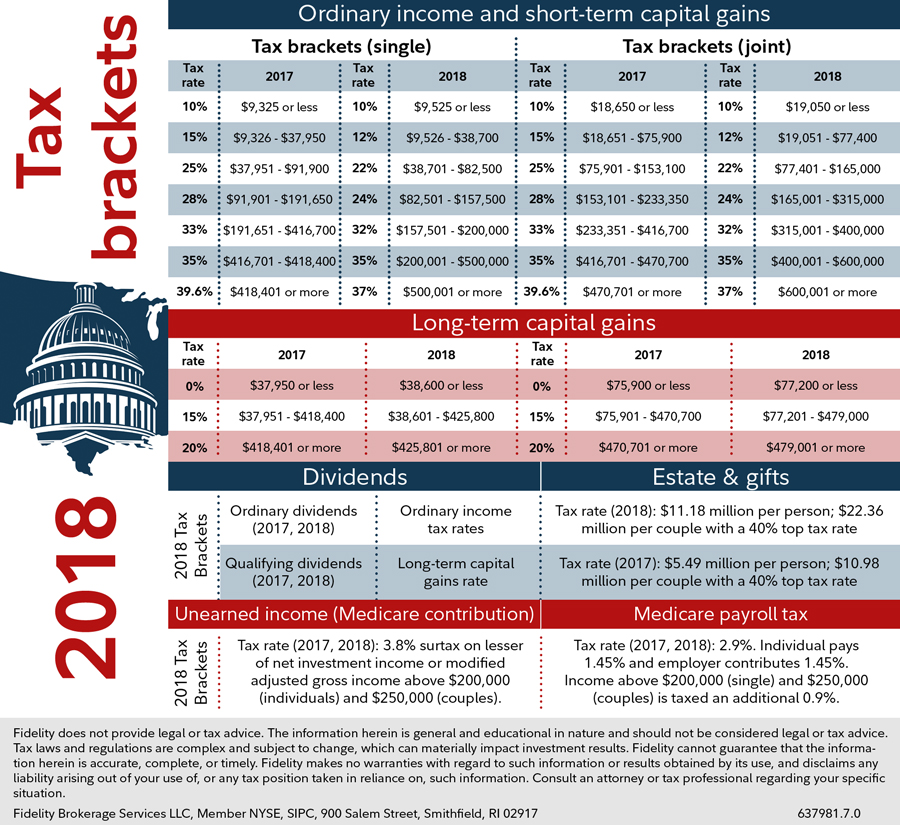

Contact a Fidelity Advisor. The current long-term capital gains tax rates for single filers are 0 for taxable. Depending on how long you hold your capital asset determines the amount of tax you will pay.

You need to report your gain by 31 December in the tax year after you made the gain. 20 28 for residential property. The Internal Revenue Service.

Ad A good tax preparer will help simplify your filing and make sure its done right. There is currently a bill that if passed would increase the capital gains tax in. Net capital gains from selling collectibles such as coins or art are taxed at a maximum 28 rate.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Short-term capital gain tax rates. Calculating Capital Gains Tax.

Short-term capital gains are gains apply to assets or property you held for one year or less. For the 20212022 tax year these tax rates are 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. As a non-resident you will pay tax on 100 of the capital gain from a property sale at 28.

If you have 50000 in long-term gains from the sale of one stock but 20000 in long-term losses from the sale of another then you may only be taxed on 30000 worth of. If you make a loss from the disposal then you set the loss against gains from another. Then there is the bad news and its two fold.

Ad Find Accountants you can trust and read reviews to compare. Property Tax specialists who help maximise tax relief deductions andexpenditure so as to minimise your Capital Gains Tax liability as a property landlord. 425 23 votes.

The Internal Revenue Service allows exclusions for capital gains made on the sale of primary residences. If your taxable. We have high standards and only recommend professionals with a track record of success.

Capital Gains advice for non-residents in Portugal. Not all assets attract. Capital gains are taxed at a lower effective tax rate than ordinary income.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. 4 rows The capital gains tax on most net gains is no more than 15 for most people.

Doing Your Own Taxes Isn T As Hard As You D Think Mustard Seed Money Tax Deductions Tax Services Tax Return

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments In 2021 Capital Gains Tax Capital Gain Tax Forms

7 Things About Capital Gains In 2021 Real Estate Investor Capital Gains Tax Capital Gain

Best Personal Finance Services In 2021 Accounting Services The Borrowers Capital Gains Tax

Cryptocurrency And Taxes Virtual Currency Income Tax Preparation Capital Gains Tax

Guide To Capital Gain What Is Capital Capital Gain Tax Preparation

Best Tax Consulting Sico Tax Tax Consulting Capital Gains Tax Tax Refund

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

Understand Form 16 Itr Form 16 Filing Taxes Income Tax Return Tax Services

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

Taxation Services Atg Accounts Payroll Taxes Capital Gains Tax Accounting

Tax Preparation Service Now Income Tax Service Tax Preparation Tax Services Tax Preparation Services

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

Negocios Finanzas Ilustraciones Gratis En Pixabay 2 Tax Services Tax Deductions Tax Preparation

Pin By Bhagath Reddy On Kros Chek Tax Services Income Tax Filing Taxes

5 Things Your Competitors Can Teach You About Income Tax Paysquare Tax Accountant Tax Services Capital Gains Tax

Tax Services Tax Services How To Plan Guidance

Section 721 Exchange Capital Gains Tax Real Estate Investment Trust Capital Gain

Pin By Eztax In Free It Gst Filing On Income Tax Filing Software Expert Services Filing Taxes Income Tax Return Income Tax